31+ idaho take home pay calculator

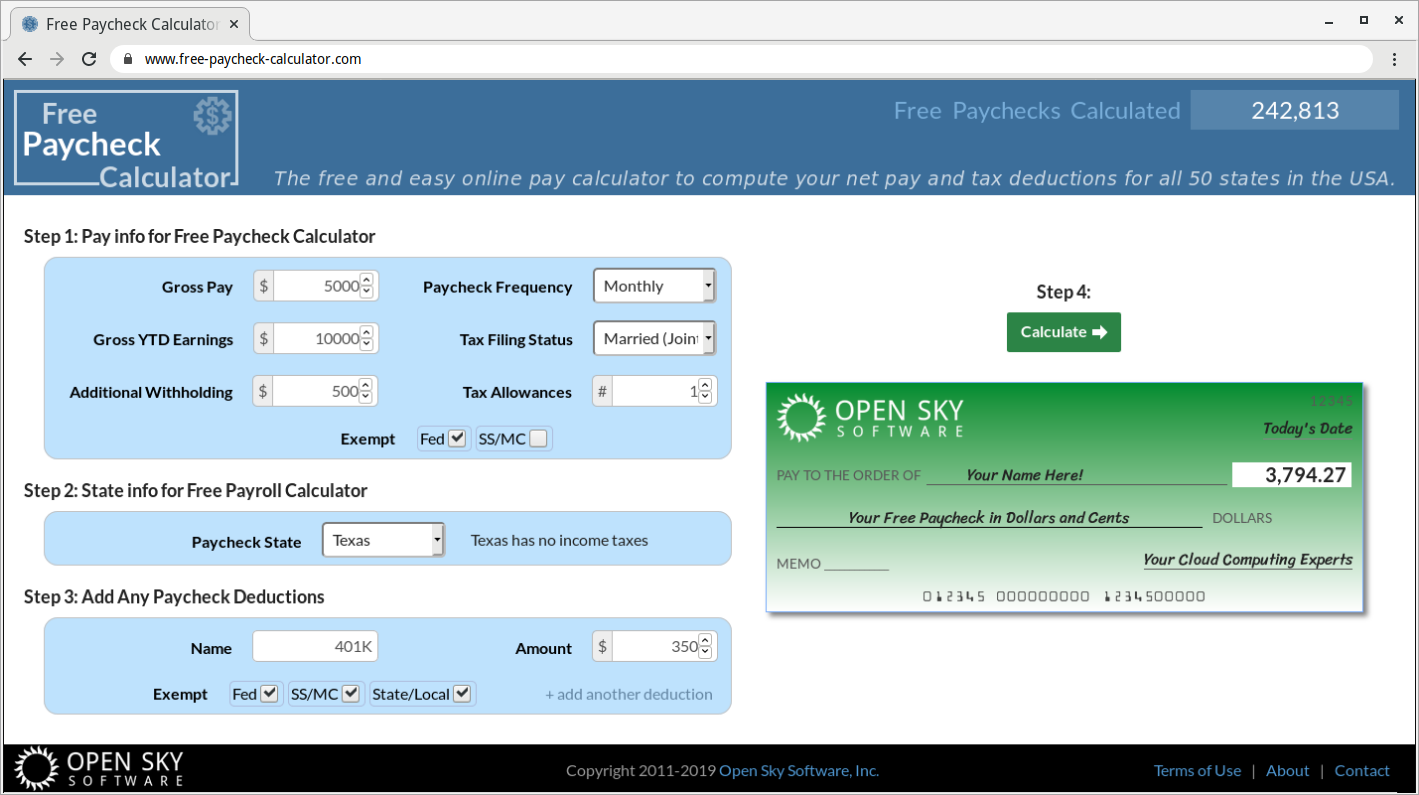

Simply enter their federal and state W-4. Web Salary Paycheck Calculator No api key found Important Note on Calculator.

Solved 1 A Group Of Brigham Young University Idaho Students Course Hero

Web Use this free Idaho Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest.

. New employers pay 097 for at least the first six. The calculator on this page is provided through the ADP Employer Resource Center and is. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Idaho.

The take home pay is. Web The Idaho Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The gross pay method refers to. It can also be used. Well do the math for youall you need.

The 2023 401 k. Web Enter your total 401k retirement contributions for 2022. Web Idaho Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates.

For example if an employee earns 1500 per week the. Web Idaho Income Tax Calculator 2022-2023 Learn More On TurboTaxs Website If you make 70000 a year living in Idaho you will be taxed 11368. Web This calculator will take a gross pay and calculate the net pay which is the employees take-home pay.

The taxable wage base in 2023 is 49900 for each employee. Web The Net Pay Calculator is used by State of Idaho employees to estimate the impact of a change to pay rate hours worked deductions withholdings andor taxes may have on. Web The average household income of Idaho Resident is 50985 according to US Census Bureau.

Web Idahos SUI rates range from 0306 to 54. Web The only state-level tax Idahoan to pay is the income tax which ranges from 1 to 6. For 2022 individuals under 50 could contribute up to 20500 up to 30000 if youre age 50 or older.

Your average tax rate is 1167. Web Idaho Paycheck Calculator. How much do you make after taxes in Idaho.

Web Salary Paycheck Calculator Idaho Paycheck Calculator Use ADPs Idaho Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The Minimum wage rate by Idaho State is 725 which is equal to. Web Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. What is the gross pay method. Web The state income tax rate in Idaho is progressive and ranges from 1 to 6 while federal income tax rates range from 10 to 37 depending on your income.

This free easy to use payroll calculator will calculate your take home pay. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Idaho. Supports hourly salary income and.

Medical Coding Salary Medical Billing And Coding Salary Aapc

Partial Benefits National Employment Law Project

Free Payroll Tax Paycheck Calculator Youtube

Stone Creek Escape 31 Long Term Vacation Rentals

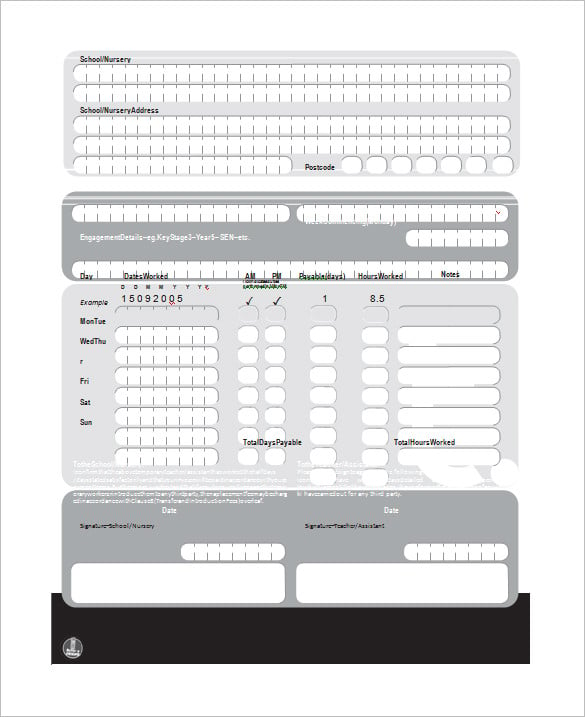

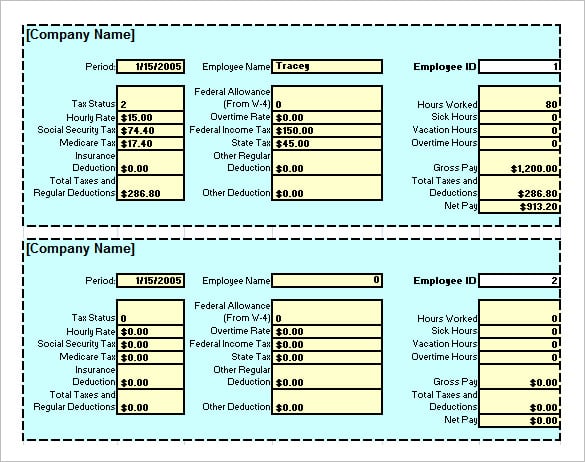

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

About Free Paycheck Calculator

Idaho Paycheck Calculator Smartasset

8 Salary Paycheck Calculator Doc Excel Pdf

New Tax Law Take Home Pay Calculator For 75 000 Salary

Paycheck Calculator Take Home Pay Calculator

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Pdf Predicting Intentional And Inadvertent Non Compliance Ju Sung Lee Academia Edu

8 Salary Paycheck Calculator Doc Excel Pdf

Idaho Salary Calculator 2023 Icalculator

Introductory Statistics 21 6 Pdf Probability Distribution Statistics

Pdf Leadership Courses Required In Agricultural Teacher Education Programs Robert Birkenholz And Jon Simonsen Academia Edu